23+ Price volatility meaning Stock

Home » Trading » 23+ Price volatility meaning StockYour Price volatility meaning mining are ready. Price volatility meaning are a exchange that is most popular and liked by everyone this time. You can Get the Price volatility meaning files here. Find and Download all royalty-free mining.

If you’re looking for price volatility meaning pictures information linked to the price volatility meaning topic, you have come to the right site. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Price Volatility Meaning. Price volatility is always expressed in terms of the annualised standard deviation of percentage price changes. It signifies what the market expects prices to fluctuate to. Price volatility refers to the tendency of an asset to rise and fall in price over a period of time. In finance volatility is a measurement of the fluctuations of the price of a security.

The Volatility Index Reading Market Sentiment From investopedia.com

The Volatility Index Reading Market Sentiment From investopedia.com

On the other hand non-volatile markets refer to markets where. Some investment opportunities have a high degree of change or high price volatility and some have a low. Investors and traders analyse a securitys volatility to assess previous price changes and forecast future moves. Price volatility describes how quickly or widely prices can change. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns.

Price volatility is always expressed in terms of the annualised standard deviation of percentage price changes.

The term price volatility is used to describe price fluctuations of a commodity. If volatility is higher it means that you will be able to enter into that pair with trade without. Volatility is how fast the price of an investment fluctuates over time. When markets are volatile this means that prices are changing fast in a short period of time. It expresses the degree of risk associated with a securitys price fluctuations. Volatility is the amount of distance between the fluctuations ups and downs of stock or foreign exchange prices.

Volatility represents how large an assets prices swing around the mean priceit is a statistical measure of its dispersion of returns. Historic volatility measures a time series of past market prices. Realized volatility is the actual range of price changes for an asset. Market price currency volatility. Price volatility is always expressed in terms of the annualised standard deviation of percentage price changes.

Source: sciencedirect.com

Source: sciencedirect.com

In finance volatility is a measurement of the fluctuations of the price of a security. Market price currency volatility. Volatility is measured by the day-to-day percentage difference in the price of the commodity. The forex market often experiences high volatility meaning prices are changing rapidly in a short period of time. Historic volatility measures a time series of past market prices.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

A higher rating means higher risk. A measure of risk based on the standard deviation of the asset return. It is a rate at which the price of a security increases or decreases for a given set of returns. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time.

Source: sciencedirect.com

Source: sciencedirect.com

In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns. Volatility is the measure of how the price of a financial product is dispersed over time and is a key factor of profit potential. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. Such as a scale of 1-9. It is essentially an analysis of the changes in the value of a security.

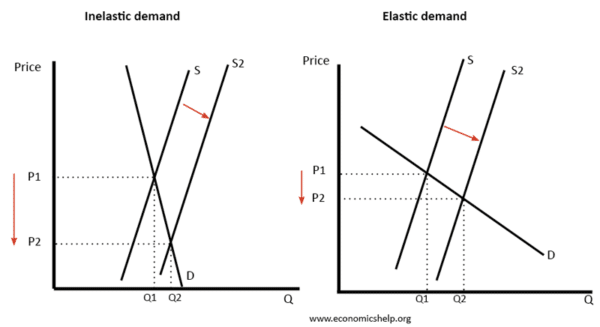

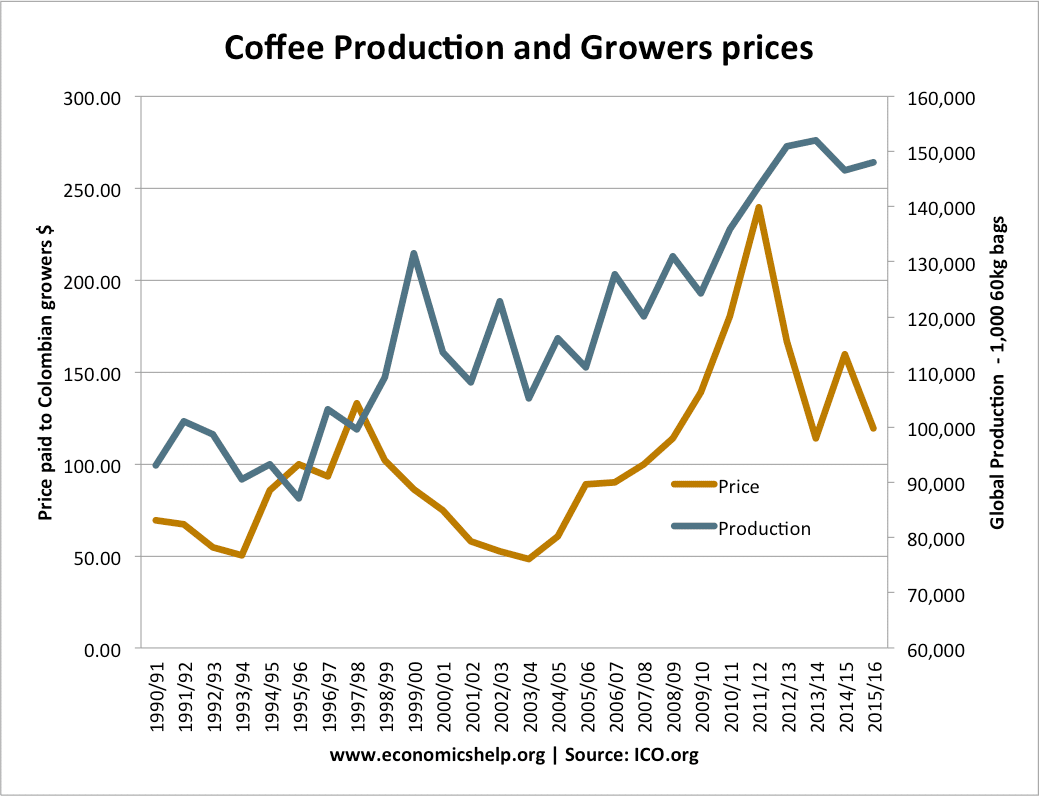

Source: economicshelp.org

Source: economicshelp.org

The term price volatility is used to describe price fluctuations of a commodity. Volatility is measured by the day-to-day percentage difference in the price of the commodity. It is one of the most key measures in quantifying risk. There are volatility indexes. Such as a scale of 1-9.

Source: investopedia.com

Source: investopedia.com

Volatility is how fast the price of an investment fluctuates over time. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. A higher rating means higher risk. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. What is Volatility.

Source: economicshelp.org

Source: economicshelp.org

Volatility is measured by the day-to-day percentage difference in the price of the commodity. Volatility is how fast the price of an investment fluctuates over time. Volatility is the amount of distance between the fluctuations ups and downs of stock or foreign exchange prices. Price volatility simply means the degree of change in the price of a stock over time. The term price volatility is used to describe price fluctuations of a commodity.

Source: youtube.com

Source: youtube.com

Volatility depends upon the range between the high and low prices of an asset and on the number of price changes it undergoes. Volatility is a variable that appears in option pricing formulas where it denotes the volatility of the underlying asset return from now to the expiration of the option. The forex market often experiences high volatility meaning prices are changing rapidly in a short period of time. High volatility means that prices go up high quickly and then suddenly fall in quickly too giving rise to a very large difference between the lowest price and the highest price at a time. A measure of risk based on the standard deviation of the asset return.

Source: investopedia.com

Source: investopedia.com

Investors and traders analyse a securitys volatility to assess previous price changes and forecast future moves. Investors and traders analyse a securitys volatility to assess previous price changes and forecast future moves. And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. The quality or state of being likely to change suddenly especially by becoming worse. Price volatility simply means the degree of change in the price of a stock over time.

Source: investopedia.com

Source: investopedia.com

It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. It is one of the most key measures in quantifying risk. In fact it does not distinguish between up and down. Historic volatility measures a time series of past market prices. What is price volatility.

Source: sciencedirect.com

Source: sciencedirect.com

Volatility is how fast the price of an investment fluctuates over time. On the other hand non-volatile markets refer to markets where. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. There are volatility indexes. Volatility depends upon the range between the high and low prices of an asset and on the number of price changes it undergoes.

Source: sciencedirect.com

Source: sciencedirect.com

And if volatility is high for the overall market get ready to swoon and not in a celebrity-sighting kind of way. In the energy industry this refers to electricity andor natural gas supply prices relative to consumer demand. The forex market often experiences high volatility meaning prices are changing rapidly in a short period of time. Volatility is a variable that appears in option pricing formulas where it denotes the volatility of the underlying asset return from now to the expiration of the option. Price volatility simply means the degree of change in the price of a stock over time.

When markets are volatile this means that prices are changing fast in a short period of time. A stock with a price that fluctuates wildlyhits new highs and lows or moves erraticallyis. Unlike the usual way people look at prices of securities and their changes up or down the volatility point of view does not care about the direction so much. A measurement of historic volatility looks at a securitys past market prices. Volatility represents how large an assets prices swing around the mean priceit is a statistical measure of its dispersion of returns.

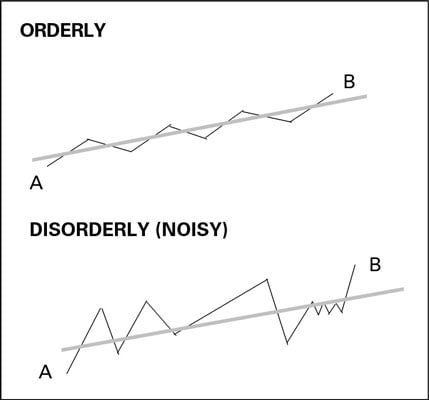

Source: dummies.com

Source: dummies.com

Volatility represents how large an assets prices swing around the mean priceit is a statistical measure of its dispersion of returns. Volatility is a measure of how much something tends to change. It is one of the most key measures in quantifying risk. The quality or state of being likely to change suddenly especially by becoming worse. What is Volatility.

Source: sciencedirect.com

Source: sciencedirect.com

It expresses the degree of risk associated with a securitys price fluctuations. A higher rating means higher risk. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time. It indicates the risk associated with the changing price of the security and is measured by calculating the standard deviation of the annualized returns over a given period of time. There are volatility indexes.

Source: capital.com

Source: capital.com

A measurement of historic volatility looks at a securitys past market prices. Market price currency volatility. What is Volatility. It signifies what the market expects prices to fluctuate to. In the energy industry this refers to electricity andor natural gas supply prices relative to consumer demand.

Source: sciencedirect.com

Source: sciencedirect.com

In finance volatility usually denoted by σ is the degree of variation of a trading price series over time usually measured by the standard deviation of logarithmic returns. It expresses the degree of risk associated with a securitys price fluctuations. It signifies what the market expects prices to fluctuate to. Price volatility refers to the tendency of an asset to rise and fall in price over a period of time. Volatility is a measure of price-change during a specified amount of time.

Source: investopedia.com

Source: investopedia.com

Price volatility refers to the tendency of an asset to rise and fall in price over a period of time. Market price currency volatility. Volatility is defined as the rate at which the price of a security increases or decreases for a given set of returns. It is a rate at which the price of a security increases or decreases for a given set of returns. When markets are volatile this means that prices are changing fast in a short period of time.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title price volatility meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 29++ 1000 dollars to pesos Stock

- 10+ 1 cad to tl Trend

- 34++ Coinmarketcap watch list Top

- 49+ Coinbase stock market Wallet

- 27+ Best trading platform for mac Best

- 27++ Best broker for pre market trading Stock

- 21++ Mt5 demo account Coin

- 17+ Usd to swiss franc Wallet

- 17++ Coin360 for stocks Mining

- 33++ Sierra charts pricing Bitcoin