29++ High volatility stocks meaning Trend

Home » News » 29++ High volatility stocks meaning TrendYour High volatility stocks meaning mining are ready. High volatility stocks meaning are a wallet that is most popular and liked by everyone today. You can Get the High volatility stocks meaning files here. News all royalty-free coin.

If you’re searching for high volatility stocks meaning images information related to the high volatility stocks meaning interest, you have come to the ideal site. Our website always gives you hints for refferencing the highest quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

High Volatility Stocks Meaning. Such organisations usually produce goods and services having industry-first features and hence are highly demanded in the market. If the prices of a security fluctuate rapidly in a short time span it is termed to have high volatility. The high volatility will keep your option price elevated and it will quickly drop as volatility begins to drop. In the stock market volatility stands for the risk of change in the price of a security.

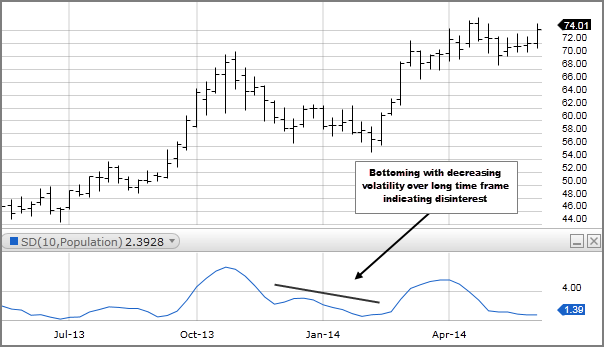

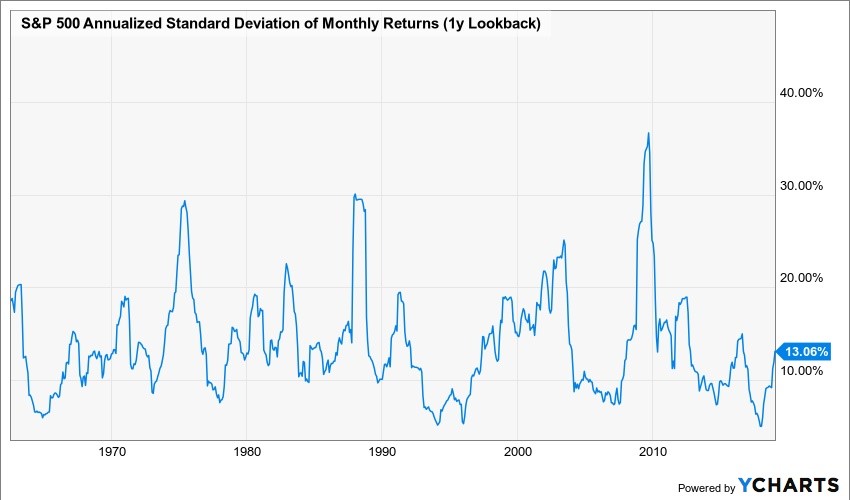

The History Of Stock Market Volatility In The United States From einvestingforbeginners.com

The History Of Stock Market Volatility In The United States From einvestingforbeginners.com

Stock with High Volatility are also knows as High Beta stocks. If the price almost never changes it has low volatility. The most volatile stocks may demonstrate price fluctuations of up to several hundred percent during the day. The volatility of a stock is the fluctuation of price in any given timeframe. While there is more risk associated with high-volatility stocks there is also greater potential reward. A stock with low volatility has a generally steady price.

In simple terms the stocks have a.

In the long term volatility is good for traders because it gives them opportunities. If the prices of a security fluctuate slowly in a longer time span it is termed to have low volatility. If the price of a stock moves up and down rapidly over short time periods it has high volatility. Volatility in the price of a stock or index is the measure of rangeextent into which the price is expected to fluctuate. Such organisations usually produce goods and services having industry-first features and hence are highly demanded in the market. Day traders and swing traders often rely on a volatility-based strategy that aims.

Source: investopedia.com

Source: investopedia.com

In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods. Stocks may see unusually-high price volatility when important new information affecting the stocks valuation is made known to the public but the market is uncertain how that news will affect. A high volatility indicates big wild fluctuations whereas a low volatility means a narrow range bound stock price. Stocks of high volatility typically have lower demand in the market especially during times of economic downturn. When a stock that normally trades in a 1 range of its price on a daily basis suddenly trades 2-3 of its price its considered to be experiencing high volatility On the other hand implied volatility is the markets perception of how much a stockor the market itselfwill move and is reflected in the price of its options.

Source: youtube.com

Source: youtube.com

Even if you were the best trader in the world you would never make any profit on a stock with a constant price zero volatility. Answer 1 of 8. A higher volatility means that a securitys value can potentially be spread out over a larger range of values. High volatility stocks meaning. A lower investment input on a highly volatile stock could prove to be significantly profitable and minimise risk since the initial investment is kept low.

Source: timothysykes.com

Source: timothysykes.com

High volatility stocks meaning. Here we are going to list down the Top 50 High Volatile Stocks NSE. A lower investment input on a highly volatile stock could prove to be significantly profitable and minimise risk since the initial investment is kept low. A higher volatility means that a securitys value can potentially be spread out over a larger range of values. A more stable stock will have a lower standard deviation.

Source: lynalden.com

Source: lynalden.com

Here we are going to list down the Top 50 High Volatile Stocks NSE. For example if a stock daily shows a movement of 3 to 10 then its a highly volatile stock this change can vary from stock to stock. Trading volatile stocks is a two-sided sword the potential is exceptionally high but it also means that the risk is high. When you buy a volatile investment you enhance your chances of success while also increasing failure risk remember that the higher the risk the. It means that the market expects the stock to be some percent away from its current price by the time the option expires.

Source: investopedia.com

Source: investopedia.com

If the price almost never changes it has low volatility. Traders with an investment mindset will often talk about volatility like its a bad thing. A high-volatility stock has a higher deviation on average than other stocks. High volatility stocks meaning. A more stable stock will have a lower standard deviation.

Source: timothysykes.com

Source: timothysykes.com

Trading volatile stocks is a two-sided sword the potential is exceptionally high but it also means that the risk is high. When a stock that normally trades in a 1 range of its price on a daily basis suddenly trades 2-3 of its price its considered to be experiencing high volatility On the other hand implied volatility is the markets perception of how much a stockor the market itselfwill move and is reflected in the price of its options. High volatility stocks mean stocks that are showing big up and down moves or one-sided big moves daily during trading hours. Even if you were the best trader in the world you would never make any profit on a stock with a constant price zero volatility. Day traders and swing traders often rely on a volatility-based strategy that aims.

Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. Such organisations usually produce goods and services having industry-first features and hence are highly demanded in the market. When a stock that normally trades in a 1 range of its price on a daily basis suddenly trades 2-3 of its price its considered to be experiencing high volatility On the other hand implied volatility is the markets perception of how much a stockor the market itselfwill move and is reflected in the price of its options. A stock with low volatility has a generally steady price. High volatility means prices change frequently and dramatically in either direction.

Source: fidelity.com

Source: fidelity.com

A more stable stock will have a lower standard deviation. For example if a stock daily shows a movement of 3 to 10 then its a highly volatile stock this change can vary from stock to stock. Therefore the higher the implied volatility the higher the expected price movement. While a highly volatile stock may be a more anxiety-producing choice for this kind of strategy a small amount of volatility can actually mean greater profits. High volatility is associated with higher risk.

Source: stock-screener.org

Source: stock-screener.org

A stock with low volatility has a generally steady price. In simple terms the stocks have a. A stock with low volatility has a generally steady price. A more stable stock will have a lower standard deviation. Implied volatility is not by itself a directional indicator.

Source: investopedia.com

Source: investopedia.com

Here we are going to list down the Top 50 High Volatile Stocks NSE. Without volatility there would be no trading opportunities and no traders. Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. High volatility is associated with higher risk. Day traders and swing traders often rely on a volatility-based strategy that aims.

Source: ruleoneinvesting.com

Source: ruleoneinvesting.com

It means that the market expects the stock to be some percent away from its current price by the time the option expires. Stocks that move in any direction fruitfully can be deemed as high volatility stocks. The high volatility will keep your option price elevated and it will quickly drop as volatility begins to drop. Stocks may see unusually-high price volatility when important new information affecting the stocks valuation is made known to the public but the market is uncertain how that news will affect. A higher volatility means that a securitys value can potentially be spread out over a larger range of values.

Source: stockmaniacs.net

Source: stockmaniacs.net

High volatility means that a stocks price moves a lot. Traders with an investment mindset will often talk about volatility like its a bad thing. Volatility in the price of a stock or index is the measure of rangeextent into which the price is expected to fluctuate. Volatility is found by calculating the annualized standard deviation of daily change in price. Our favorite strategy is the iron condor followed by short strangles and straddles.

Source: investopedia.com

Source: investopedia.com

Stock with High Volatility are also knows as High Beta stocks. If the price almost never changes it has low volatility. A lower investment input on a highly volatile stock could prove to be significantly profitable and minimise risk since the initial investment is kept low. Volatility stands for the risk of change in the price of a security. High volatility is quite risky as it giv.

Source: fidelity.com

Source: fidelity.com

For example if a stock daily shows a movement of 3 to 10 then its a highly volatile stock this change can vary from stock to stock. In simple terms the stocks have a. The high volatility will keep your option price elevated and it will quickly drop as volatility begins to drop. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods. High volatility stocks in 2020 are primarily issued by small and mid-cap companies or start-ups showing tremendous potential for growth and are expected to thrive during favourable economic conditions.

Source: investopedia.com

Source: investopedia.com

If the price of a stock moves up and down rapidly over short time periods it has high volatility. Volatility stands for the risk of change in the price of a security. Answer 1 of 8. Such organisations usually produce goods and services having industry-first features and hence are highly demanded in the market. The volatility of a stock is the fluctuation of price in any given timeframe.

Most volatile stocks are companies that have had large price swings leading to a significant gap between these companies intraday highs and intraday lows. High volatility means prices change frequently and dramatically in either direction. Answer 1 of 8. A stock with low volatility has a generally steady price. In the stock market volatility stands for the risk of change in the price of a security.

Source: fosterandmotley.com

Source: fosterandmotley.com

High volatility means prices change frequently and dramatically in either direction. A stock with low volatility has a generally steady price. In simple words it is a rate at which stock price increases or decreases over time. Whether they move within a 5 range continuously move up or down they can. A volatile stock simply means it moves.

Source: investopedia.com

Source: investopedia.com

Stocks can be classed as currently volatile describing those stocks with current high swings or expected to be volatile meaning stocks that may be stable at this moment but have. In the developed markets volatility tends to be much lower and doesnt exceed 20-30 during the quiet periods. While there is more risk associated with high-volatility stocks there is also greater potential reward. Even if you were the best trader in the world you would never make any profit on a stock with a constant price zero volatility. In the stock market context rapid price fluctuation in either direction is considered as volatility.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high volatility stocks meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 39+ Usd to lebanese pound Top

- 21+ Etoro spread Wallet

- 14+ Best free expert advisor for mt4 Stock

- 50++ Lonelyfans coin Trading

- 11++ Vertcoin coinmarketcap Wallet

- 13+ Nas100 on mt4 Best

- 25+ Usd to inr history Coin

- 16+ Hubspot digital asset management Trending

- 38++ Money is functioning as a medium of exchange if you Top

- 10+ Fxchoice mt4 News